Understand how that affects you and your taxes. Older adults have special tax situations and benefits. Ting Vit Older adults have special tax situations and benefits. In another example, due to the progressive rate schedule, considering income exclusions jointly will push some taxpayers into higher tax brackets and thus increase the joint estimate relative to the individual tax expenditure estimates. Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules. the IRS withhold some or all of your unpaid stimulus payment and tax return. For all individuals who are retired from the federal government, the Commonwealth of Kentucky, or a Kentucky. This is because, when all are repealed at once, it is more likely that a taxpayer’s optimal tax form behavior would be to claim the standard deduction which limits the total revenue gain from repealing the itemized deductions. Under the CARES Act, your 1st stimulus payment (approved April 2020) could. Schedule P, Kentucky Pension Income Exclusion. All of these are relatively small increases from 2017. The credit is 3,468 for one child, 5,728 for two children, and 6,444 for three or more children. When considered individually, the sum of their effects on revenue is greater than when they are considered jointly. The maximum Earned Income Tax Credit in 2018 for single and joint filers is 520, if the filer has no children (Table 9).

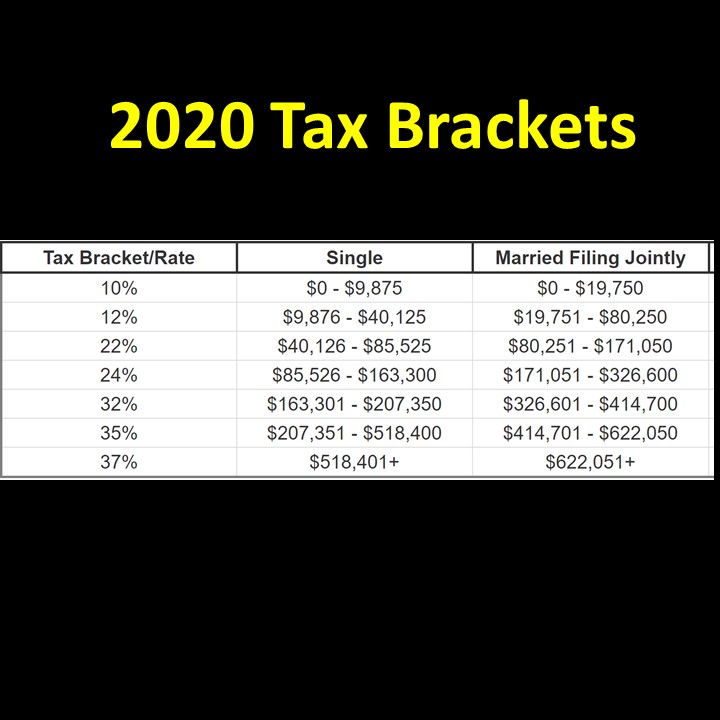

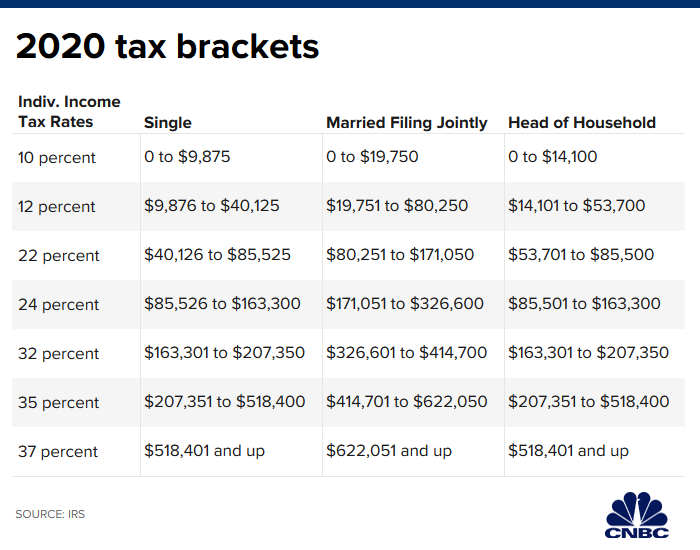

This could also mean that you will pay a different tax rate on part of your income for your 2022 return. Indexing has increased the income brackets by roughly 2 across the board. And as a result, you might find yourself in a different tax bracket for 2022 than you did for 2021. Federal income tax brackets and rates for 2019 are shown below. Note that the brackets are adjusted from year to year for inflation. For example, the individual itemized deductions for charitable contributions, mortgage interest expense, and state and local taxes are all tax expenditures. Now, compare the 2022 tax brackets above with the 2020 brackets below. These interactions can increase or and decrease the estimated revenue effects of tax expenditures. Because of interactions between provisions, generally it is not correct to add separate tax expenditures for each provision to obtain a total for repealing all at once.

#Irs tax brackets 2020 vs 2019 for seniors code#

An important assumption underlying each tax expenditure estimate reported below is that other parts of the Tax Code remain unchanged.

0 kommentar(er)

0 kommentar(er)